By Kevin Weber

Blog

Simplifying airline systems: Why payment and retailing must converge

One of the most enduring truths about commercial aviation is that airline operations are mired in complexity. Commercial aviation is defined by its complexity – especially in managing dynamic offers, inventory fulfillment, and cross-border transactions. Traditional airline systems are fragmented, creating inefficiencies in transaction routing, inventory management and multi-payer processing.

From managing dynamic offers and inventory fulfillment, handling ancillary services and multi-payer transactions, to navigating cross-border payments and optimal transaction routing, current systems have proved fragmented and inefficient.

This has resulted in lost revenue, operational bottlenecks and frustrated customers – challenges that airline leaders have long recognized and, to a degree, accepted.

Why are solutions to these challenges so elusive? In part, because innovations in airline technology are too seldom directed toward the comprehensive reimagining of sales, distribution and payment systems, instead focusing on incremental efficiencies that leave legacy silos intact.

However, integrating modern payment systems with new airline retailing frameworks such as Offer-Order-Settlement-Delivery (OOSD), based on IATA’s New Distribution Capability (NDC), could help eliminate these silos, enabling a consistent and scalable approach to commerce.

This fundamental transformation is reshaping how airlines approach retail strategy and could hold the key to resolving the industry’s most pressing challenges.

But to fulfill the promise of this evolution, airlines must also embrace payment systems that can accommodate and facilitate the broad potential of OOSD.

The inverse is also true: airlines that fail to adapt their payment systems and strategies will fail to reap the revenue and customer experience benefits of modern retailing approaches.

OOSD represents a fundamental change in airline distribution strategy. It alters the balance of control from GDSs and third-party intermediaries back to airlines’ direct sales channels, enabling carriers to dynamically construct, price and deliver personalized travel experiences.

This transition is gaining momentum.

According to the Airline Reporting Corp. (ARC), NDC transactions accounted for 20.3% of the total ARC-reported and settled transactions in December 2024 10% increase from 18.4% in December 2023.

This indicates significant adoption growth across the travel ecosystem, though full implementation of OOSD retailing remains a multi-year journey for most commercial air carriers.

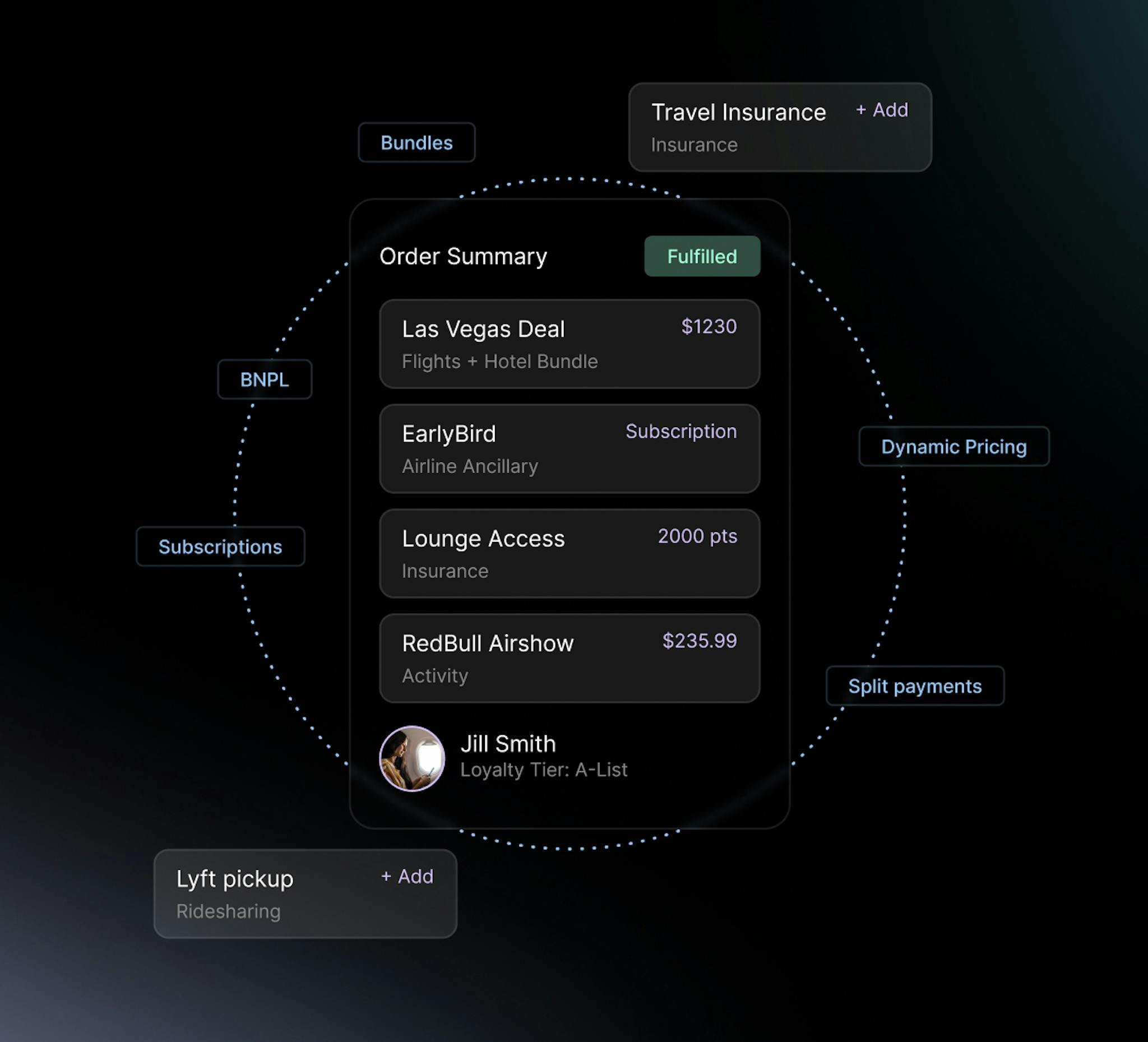

Like they always seem to be for airlines, the stakes are high. Effective merchandising, smart messaging and dynamic pricing, all capabilities enabled by OOSD, can have a major positive impact on topline revenue and overall financial performance. Likewise, the ability to package and sell ancillary offerings beyond traditional flight-related products (encompassing ground transportation, accommodations and activities) in a single transaction and booking flow presents vast new revenue opportunities for airlines.

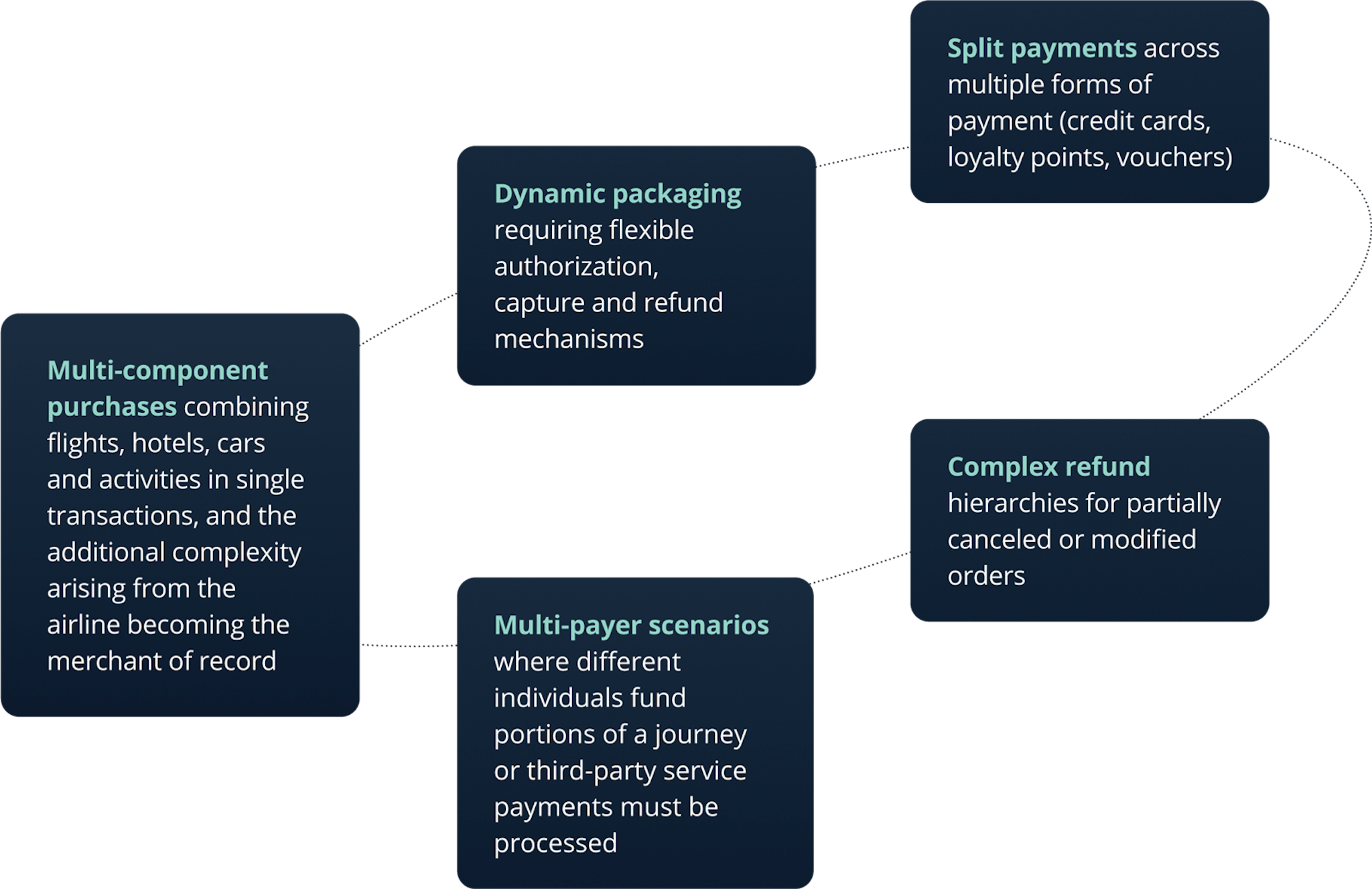

Despite this potential, as airlines advance toward OOSD adoption, payment processing emerges as a critical bottleneck. The traditional airline payment ecosystem – designed for simple flight transactions and limited payment methods – can’t keep up with the marketplace-style commerce that OOSD enables.

New complexity Challenge:

As more modern retailing creates opportunities for growth, it also uncovers complexities Payment Orchestration can simplify

These challenges are particularly acute in today's travel environment. The airline industry (and the travel sector more broadly) has one of the highest cart abandonment rates, representing billions in lost revenue opportunity. As OOSD enables airlines to create larger packages (and larger dollar value transactions), the travel planner’s temptation to skip checkout will only grow.

Meanwhile, PYMNTS research indicates that 60% of shoppers overall opted for split payment options in the last year, a capability many airlines struggle to support.

Our 2024 report, Payments Come of Age, found the top three challenges reported by the 151 global airline professionals polled for the report:

- Not enough alternative payment methods (APMs) or regional forms of payment

- Not enough foreign currency support

- Building ancillary revenue

Bigger carts plus fewer payment options consumers want is hardly a recipe for revenue optimization.

Legacy payment approaches, often siloed by channel and market, cannot efficiently meet passenger demand for payment flexibility nor manage the complexities of travel transactions at scale.

Payment Orchestration platforms, offer a comprehensive solution to these challenges. These platforms integrate diverse payment capabilities into a unified ecosystem featuring a variety of configurable business rules engines.

Our next next generation Payment Orchestration Platform provides several critical capabilities for airlines transitioning to the OOSD retailing model, including:

- Rules engines to govern which forms of payment (including combined payments like points and cash) are displayed Split payment processing for complex order structures

- Multi-payer transaction support

- Dynamic payment routing and optimization

- Comprehensive refund hierarchy management

- Service-level provider payout capabilities

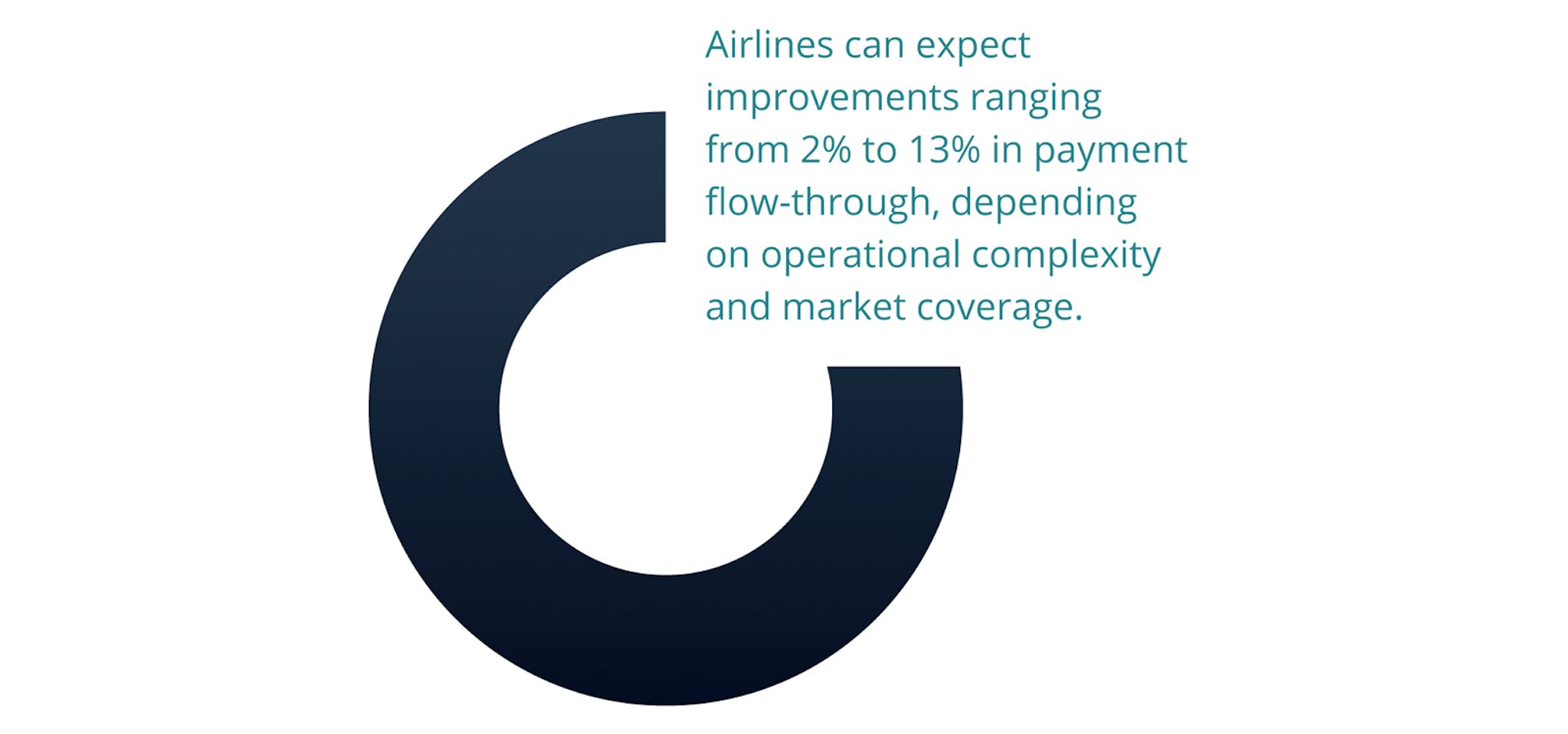

Our internal ROI modeling for Payment Orchestration shows that when these capabilities are implemented, airlines gain significant improvements across the entire payment value chain. From reducing operational friction and payment failures to enhancing authorisation performance and customer experience, the impact is both immediate and long-term. These gains empower airlines to capture more revenue, streamline global operations, and future-proof their infrastructure as they transition to modern retailing models like OOSD.

For carriers operating across multiple regions with diverse payment methods, the benefits tend toward the higher end of this range. These improvements stem from addressing multiple friction points in the payment process, including cross-border routing, currency conversion and regulatory compliance, that traditional legacy systems cannot effectively manage.

Perhaps the most significant advantage of Payment Orchestration platforms is their ability to eliminate operational silos in airline ecommerce.

In traditional airline operations, payment processing often exists independently from inventory management, ticketing and ancillary sales. Each function maintains separate systems, processes and data stores. This fragmentation creates inefficiencies, revenue leakage and disjointed customer experiences.

OOSD-ready payment platforms integrate directly with the three core components of the new airline retail infrastructure:

For global carriers with annual revenues exceeding $10 billion, even a 2% improvement in payment performance translates to $200 million in incremental annual revenue – a substantial return on investment. And as average order values increase under OOSD (with customers purchasing bundled travel experiences rather than standalone flights), optimizing payment performance becomes even more critical. Failed payments on high-value orders represent more significant foregone revenue than airfares alone.

Airlines pursuing OOSD transformation face a critical question: how to implement payment capabilities that support both current and future requirements.

There are several steps to a successful conversion of retailing and payment systems, including:

This approach aligns with broader industry trends. IATA's Airline Retailing Maturity Index shows carriers advancing at different rates toward modern retail capabilities. Payment Orchestration platforms that support hybrid environments – bridging legacy and OOSD worlds – provide the flexibility airlines need during this extended transition period.

As airlines transition to modern retailing practices and pursue new growth strategies, Payment Orchestration is emerging as a critical enabler of successful OOSD strategies. By eliminating silos between payment processing and core retail functions, Payment Orchestration platforms unlock the full potential of OOSD while delivering immediate financial benefits.

The transition to OOSD represents the industry's most significant distribution shift in decades. Airlines that address payment complexity as a core component of this transformation will position themselves for a competitive advantage in an increasingly dynamic marketplace.

As you evaluate your airline’s approach to retailing and distribution, Payment Orchestration should be considered not merely as a technological enhancement but as a strategic capability that directly impacts revenue performance, operational efficiency and customer experience.

It can be helpful to discuss the ramifications of payment strategies in the context of OOSD transition with a trusted partner; you can connect with a CellPoint Digital expert any time to walk through the nuances of your airline’s journey toward modern retailing.